To scale startup marketing, you’ll need to set a marketing budget, invest those dollars and report on results. You’ll wonder how much to spend, which channels to invest in and how to measure performance.

As you scale, the next level marketing budget challenges you’ll face may be how to:

- Hit user acquisition targets while also justifying spend that doesn’t work yet

- Unlock new channels as your most profitable channels hit a ceiling

- Grow when marginal spend isn’t profitable, but blended LTV:CAC is good

- Measure attribution without the expertise or bandwidth to perfect your data

- Win the market when a competitor is outspending you

Here are guidelines to frame your thinking around marketing budget decisions as you scale.

Define your spend by working media, non-working media and payroll

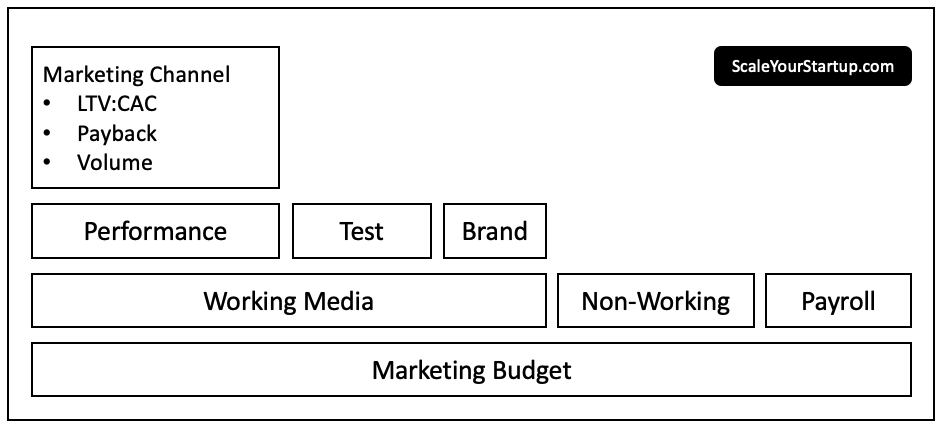

Divide your marketing budget into a) working media, b) non-working media and c) payroll.

Working media is money you spend on advertising. Non-working media is money you spend on non-advertising activities (e.g. software, SWAG, etc). Payroll is the fixed cost of your marketing team.

Working media is more variable and more scalable. You need to count this against your customer acquisition costs. Breaking out non-working media helps you isolate other investments on your CAC. Ad spend can be scaled up or down without the other budgets. Including operating expenses in your CAC calculation skews thing wrong way.

Bucket your working media into performance, test and brand spend

Within your working media, bucket your spend into performance, test and brand marketing. The performance bucket should include the majority of your spend. This includes the highest spend channels and those that work. The test bucket should include channels where you are still experimenting. These are channels where you are not spending quite as much and the spend isn’t ROI positive quite yet. The brand marketing budget may be harder to measure at startup scale.

When you report on CAC you may look at it a few ways. Performance only, all working media, fully-burdened including ALL marketing expenses. Depending on your audience, you may want to share different numbers.

Invest into ROI positive channels, but test new channels too

If you only invest in profitable channels, you risk hitting a ceiling. How do you invest resources against channels that aren’t quite working yet? Set a thesis, understand why you think the spend will work and why it isn’t yet, and begin testing.

Have you not optimized acquisition on this media source yet? Is your funnel still broken but you need the traffic to test improvements? Do you expect CACs will never be lower and your LTVs may rise over time? Do you have a marketplace business where demand also helps grow supply? Are you in a race for marketshare against a competitor?

If you have a valid thesis, set some parameters around how much or until when you’ll spend. If you don’t, kill the spend and use the cash for something else.

Level of brand investment depends on how important brand is to winning

If you are a performance marketer, you may shy away from brand spend. Push yourself to consider where this investment may help.

If you are a brand marketer, you may spend too much here and should cut back. Push yourself to measure ROI.

Investing in brand enables you to build awareness. Over time, this should improve organic acquisition costs, lifetime value and referrals. Some startups generate viral growth with minimal performance marketing spend. Other startups are in competitive spaces and brand is the primary differentiator. For most tech startups, brand is about the product experience. There are many good reasons to invest in brand. Know why you are doing it and pick a number that feels right for you.

Stack rank your marketing channels; focus marginal ROI not blended

When allocating budget, you should stack rank your channels based on LTV, CAC, payback and volume. Any channel that hits your LTV:CAC and payback targets, you should spend on. The one exception may be if the opportunity cost of your time isn’t worth the incremental volume.

Marginal returns may go down, but if organic is high enough on a blended basis your ROI thresholds may look okay. In a cash constrained environment, if marginal spend isn’t ROI positive you may want to pull back. In some cases your paid spend lifts your organic acquisition, and as such you can continue to spend.

Attribution won’t be perfect; keep it simple and layer in complexity later

Attribution is science, but there is some art too.

You may start off with one or two data sources. Google Analytics, promo codes, or a post-purchase survey are all a good place to start. You can then build a model and triangulate the data points you can capture.

Llast touch attribution will tend to favor demand capture channels such as SEM and SEO. First touch or a mixed model will tell a better story around awareness channels. A short attribution window forces you to optimize the bottom of the funnel. A longer window may enable you to go up funnel. It is a judgement call with tradeoffs. Make the best guess you can, run with it. Evolve the model as your spend scales and the tradeoffs become more material.

When the competition is outspending you, pick a niche to win

There are a few rules of thumb for thinking about this.

In a winner take all market, you may need to raise money and spend more to fuel your growth engine. If you don’t spend, you lose. If you do spend, you might lose.

In a market with room for more than one player, then you should consider what game you want to play. Can you:

- focus on one geography, vertical or other area you can dominate with less cash?

- tell a story about the health of your business?

- position yourself as an attractive number two for someone to acquire?

Startups will often spread themselves too thin. With less cash, pick a niche where you can be #1 at, run the business well, and have some patience.

In summary

There are no “right” answers. There are rules of thumb, and the best companies usually break them and create their own rulebook.