Over nearly a decade, I’ve had the opportunity to build one of the biggest privately held consumer marketplace businesses, as well as invest in, advise and learn from countless other marketplace operators and investors. From gig marketplaces for medical spas to real estate marketplaces in transportation. Here are my thoughts around order of operations for scaling a startup marketplace business.

There are four phases to scaling a marketplaces business, including:

- Wedge

- Flywheel

- Moat

- Expansion

1. Marketplace Wedge

Founding a marketplace business begins with a wedge. The wedge is a unique niche or insight overlooked by others enabling you to enter or create a market. For SpotHero, it was peer-to-peer parking near Wrigley Field. For Cameo, it was helping B-list celebrities monetize fan connections. For Uber, it was better use of black cars. For AirBnB, it was renting a mattress in someone’s apartment.

Every marketplace needs a wedge. Suppliers generally want a no-brainer value prop (e.g. low effort incremental revenue). Buyers want something unique enough that a sub-par software product for now is okay. If you have something that can improve the status quo by 10x, even if it isn’t there on day one, you are onto something.

During the wedge phase, focus on:

– Understanding your best customers

– Solving marketplace onboarding (chicken v egg)

– Validating unit economics

– Finding product-market fit

Until you nail the wedge, it is generally best to stay focused on one geography or one vertical.

2. Marketplace Flywheel

The Flywheel is about marketplace liquidity and accelerating growth via network effects.

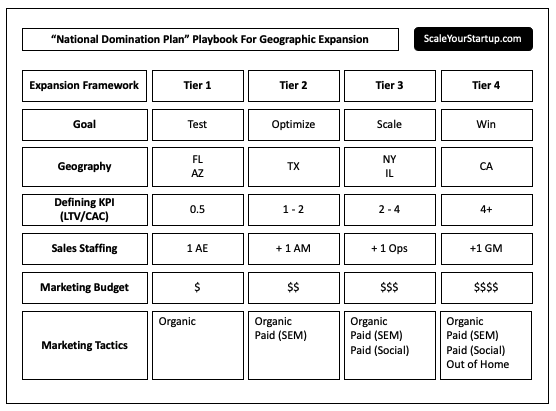

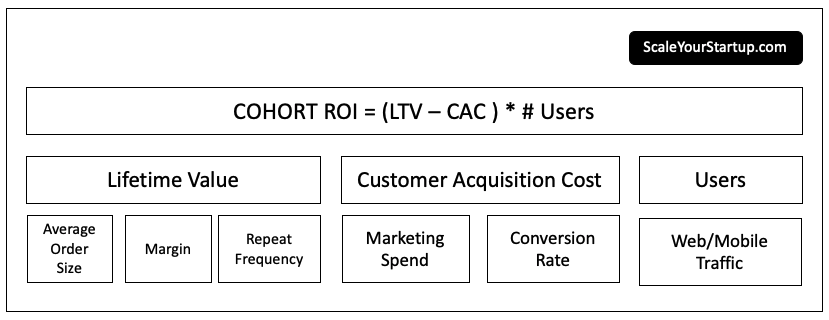

Here is where you build your playbook to onboard supply, find customers, and expand. As you get more supply your conversion rate (CAC), repeat rate (LTV) and payback begin to improve. This virtuous cycle of more supply, more demand and better economics is the goal.

In a geo-local marketplace, you scale to new cities.

In a digital marketplace, you scale to new categories.

As you find your flywheel, you can raise capital, hand your playbook to smart folks, and let them run it to expand.

Expanding too soon (e.g. unit economics don’t work) can lead to value destruction. Expanding too late can mean being too late to build your moat.

As soon as you figure out your Flywheel Playbook, it is time to pour fuel on the fire. If your new markets are scaling faster than the first first market, you are on to something.

During the Flywheel Phase, focus on:

– Liquidity (right balance of supply/demand)

– Writing your expansion playbook

– Measuring network effects

– Report on improving economics & accelerating growth

– Raising capital to expand fast enough

3. Marketplace Moat

The Moat phase is about achieving scale. Many marketplaces are winner take all or winner take most. With scale comes new opportunity. During the Moat phase, you often try to own the entire vertical and/or horizontal stack while taking advantage of your network effects and scale. You can focus on being the linchpin for suppliers and default solution for your buyers.

In this phase, you focus on:

1. Focus on locking in market share

2. Building or partnering fill any product gaps

3. Optimizing pricing and lifetime values

4. Improving margins and operating leverage

5. Using scale to focus on M&A

4. Marketplace Expansion

The expansion stage is where it gets interesting. You’ve won your market, but to ensure long-term success you need to expand TAM or LTV. You need to be able to reach for a higher north star.

Once you have line of sight to a moat in your core market, what is next? You can add services, markets, or business lines. What else would existing customers buy? What tools do suppliers need? What core competencies do you have that you can spin out into a new offering?

For example, Uber launched Uber Eats with its network of drivers.

AirBnB started Experiences to give travelers things to do. Amazon turned its internal cloud hosting services into a business for others to use.

The expansion stage can be a challenge because at this point you have a big business and building upon it can feel like the highest short term ROI. Your are now judged on financial performance, not just vision. In addition, you’ve probably hired talent that is great at optimizing and may have lost some of the early talent that prefers to start and build things. But for long term success you need to seed smaller projects that leverage your strengths to enable future growth. Find a way to continue to innovate and allocate resources to new bets.

In this phase, you focus on:

1. Owning your category (e.g. Facebook re Social Apps)

2. Adding new services for existing customers (e.g. AirBnB re experiences)

3. Building more tools for suppliers (e.g. Shopify re seller tools)

4. Spinning out new business lines (e.g. Amazon re AWS)

Some of the biggest businesses in the world are marketplace businesses. They all started with a narrow focus (wedge), expanded upon their strengths (flywheel), grew into a market dominant position (moat) and eventually layered in new lines of business (expansion). When studying those businesses, look at how they started not just where they are today.

The order of operations matters.